Returning to the "New Normal" in the Workplace

FLEXIBLE/ REMOTE WORKING

In anticipation of returning to the workplace many employers now face the decision as to whether they will be able to facilitate flexible working.

Flexible working itself has been an item of discussion for a while now, but with the introduction of working remotely being added to shorter working weeks, flexible hours, job sharing, part time working and what has now become known as hybrid working, pressures are now different.

The government intends to introduce legislation giving employees the right to request remote working. This will not establish an “entitlement to remote working”, but employers will be expected to justify why they have declined a request, should an employee refer a claim to the Workplace Relations Commission. This is, in effect, creating an indirect right, as it will be up to a third party to decide if the employer has acted reasonably.

In anticipation of these changes, the following are matters which need to be considered before implementing any general remote working arrangements.

EVALUATE

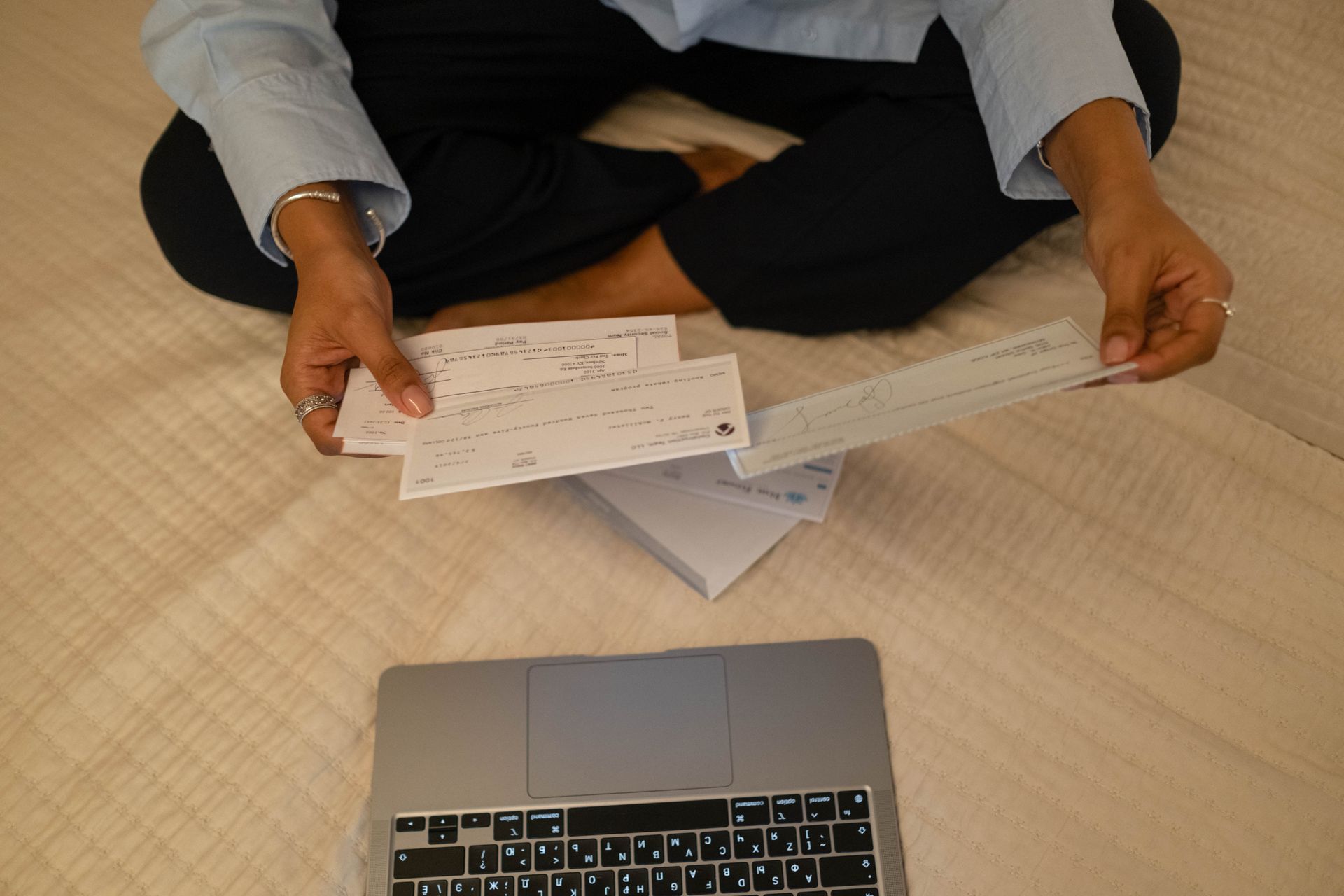

Employers must now evaluate their own operational needs and decide if flexible working, and in particular, remote working, is the way forward for their business. The last 17 months will have identified pros and cons for both employers and employees, but that was in an emergency environment. In the normal environment there will be many things to consider which we did not take account of over the last months, such as the work environment at home e.g., sitting on a bed/couch or wherever one could find, family or dependents distracting, working arrangements. Some of these would not be acceptable in an ongoing arrangement.

We believe employers should, in the first instance, return to the pre COVID working arrangements, assuming of course they are in position to provide the appropriate safe working place, allowing for social distancing, sanitisation, mask wearing and a safe workplace, and start from there.

SHORT TERM PLANS FOR A COVID SAFE RETURN

Employers should:

- Determine if any roles should be prioritised for return to the workplace.

- Identify employees who need to continue to work from home in the short term, for example, because they remain vulnerable or have ongoing health conditions.

- Calculate safe office occupancy levels in order to maintain social distancing and to meet the requirements of the Return to Work Safely Protocol.(https://enterprise.gov.ie/en/Publications/Publication-files/Work-Safely-Protocol.pdf)

- Stagger the return to work to ensure a controlled safe return.

- Consult with employees (and trade unions were applicable) on plans for returning to the workplace and encourage them to raise questions or concerns.

- Listen to the employees and learn more about their experiences of working during the pandemic.

Employee considerations:

Initially, consider whether it is appropriate to your business to adopt flexible /remote working. If so, what legal obligations arise under health and safety, employer liability insurance, protecting data, providing suitable equipment, and ensuring that good communication between workers, both office based and remote, will not be damaged.

Assuming it is possible to facilitate remote working these steps should be followed: -

COMPANY POLICY

Create a Remote Working Policy

This will;

- define the type of positions which may be suitable to be worked remotely

- clarify roles and responsibilities for flexible workers and people managers

- define flexible working with regard to the specific organisational context. This might include several different forms of working depending on role and team requirements.

- define whether there will be fixed working hours, core working hours or flexible working hours

- set timelines for applications, responses, and re-applications in cases of refusal

- define the appeal process specifically relating to this

- detail what costs or contribution to costs, if any, an employer is willing to make

- define the processes for H&S assessment/self-assessment

- define minimum working/operating requirements – e.g., Ability to work undisturbed, suitable broadband connections, ability to ensure documentation is kept secure and compliant with GDPR obligations, suitable workstation/area, working hours

- define what communication tools will be required e.g., landline, mobile, online

- define the steps for changing or ending a flexible working arrangement

Having decided on how the company wishes to approach flexible working the next step is to proceed and deal with any requests received for remote working.

We believe the key steps towards introducing remote working should include:

- Planning for and responding to the organisational implications of remote working on matters such as technology, employee wellbeing, inclusion and facilities.

- Reviewing systems and equipment available in offices and provided by individuals in order to assess whether it will appropriately support remote working.

- Put a plan on how Health and Safety will be measured for those who are working remotely. The minimum of Display Screen Assessments for each employee will have to be conducted and workstations in employees’ homes will have to meet all the requirements. Possibly introducing audits of workstation by a way of visit, online or sending pictures to document that the workplace is appropriate.

- Decide how you will put in place appropriate security measures to ensure system and data integrity.

- Ensure all the criteria included in the Organisation of Working Time Act and Code of Practice to Right to Disconnect are met i.e., keep appropriate records, make sure that employees are taking their breaks and are not working excessive hours.

- Reviewing other related policies including, for example, expenses, IT usage, homeworking and data protection.

- Remote/flexible working sometimes can be undertaken on an informal basis without a contractual change. Employers should make sure that employees and managers understand the differences and the implications of both and need to decide on the approach taken if remote/flexible working is going to be a formal change of employees’ terms and conditions of employment.

THE WELLBEING OF REMOTEWORKERS

What has become very clear is that greater attention needs to be paid to the remote worker when it comes to their wellbeing, especially if contact with office and work colleagues is significantly reduced.

Consider the following:

- Providing training and support to employees on managing work-life balance whilst working out of the office.

- Offering training on digital wellbeing and having healthy habits in relation to technology use, including helping employees to mindfully disconnect.

- Helping managers to understand the potential wellbeing implications of remote working and equipping them to have appropriate wellbeing conversations.

- Ongoing mental health support and information for all employees.

- Ensuring managers are aware of potential signs and symptoms of poor wellbeing or mental health, as these may be weaker whilst employees are working in a remote or hybrid way.

CONSIDERING APPLICATIONS

When considering an application, it is important to operate in accordance with the general principles detailed in your policy. Consider the reasons why a person wants to remotely work. Remote working is not to enable people to reduce child minding costs or caring for dependents or combining working hours with other activities.

Consideration should also be given as to how a request impacts work colleagues, the flow of work, the need for informal communication between work colleagues and all things that are not achieved well by online communications, where people need to make appointments to meet/chat.

Consider the long-term effects of such an arrangement. Whether we like it or not, the longer such an arrangement is in place the more a person will see it as their permanent way of working.

What precedence will it set within the department/company, and will it be possible to extend it to all in the department/business affected, as everyone will have the right to ask.

CONCLUSION

There are probably many other points that will merit consideration, but what is clear, is that any form of flexible working, and particularly remote working, cannot just suit the employee benefitting. It must also be acceptable to co-workers, does not compromise the business and must allow for changes in the future as business demands and practices change.

Over the last 17 months many have decided this is how they would like to work going forward. Some will have decided it is not all they thought it would be. We believe this is going to be a difficult number of months ahead as we try to get to grips with a new type of working that is being forced upon all employers, so it is important this is planned carefully and managed carefully to protect the interest of the business as a whole.

For further guidance you can refer to the government guidelines on remote working: https://enterprise.gov.ie/en/Publications/Publication-files/Remote-Working-Checklist-for-Employers.pdf

This update is provided by the MSS HR Support Service

Further details on the update or about our services may be obtained from:

John Barry/ Tara Daly/ Hugh Hegarty at Tel: 01 8870690

Contact Us

HR

+353 1 887 0690

hr@mssthehrpeople.ie

Recruitment

recruitment@mssthehrpeople.ie

Connect With Us

Sign-up To Our Newsletter

Thank you for signing up to our newsletter.

Please try again later.

© Copyright 2023 | All Rights Reserved | Privacy Policy